Investing is one of the most effective ways to build long-term wealth, but it comes with risks if not managed wisely. Many investors, especially beginners, make avoidable mistakes that can cost them money and peace of mind. Understanding these…

Oyuncuların masa seçiminde dikkat ettiği en önemli unsur, krupiyenin profesyonelliğidir; guvenilir casino siteleri en iyi krupiyelerle çalışır.

Investing is one of the most effective ways to build long-term wealth, but it comes with risks if not managed wisely. Many investors, especially beginners, make avoidable mistakes that can cost them money and peace of mind. Understanding these…

Debt consolidation is often marketed as a simple solution to managing multiple debts. By combining different balances into one loan, you replace several payments with a single monthly bill. While this approach can reduce stress and streamline finances, it…

Many common financial missteps can undermine stability and long-term growth, but awareness makes them easier to avoid: Living Beyond Your Means: Spending more than is earned or relying on credit cards leads to debt. Create a realistic budget and stick…

Teaching children about money is one of the most valuable lessons parents can offer. Early financial education fosters responsibility, independence, and wise decision-making as children grow. The process should be hands-on, engaging, and age appropriate. Start Early: Even young children…

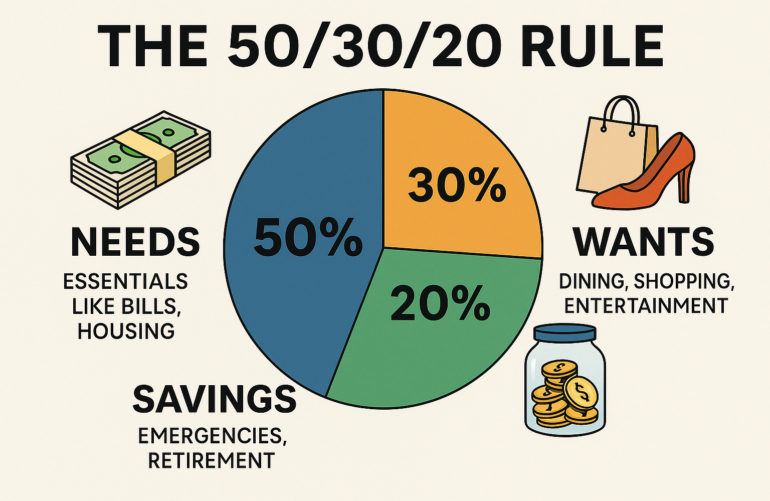

Managing money can feel overwhelming, but it doesn’t have to be complicated. The 50/30/20 rule is a straightforward budgeting method that helps people take control of their finances while still enjoying life. It’s simple, flexible, and effective for anyone…

Compound interest is often called the eighth wonder of the world, and for good reason. It has the power to turn small, consistent investments into significant wealth over time. Understanding how it works can help anyone—from students to seasoned…

Life is unpredictable, and unexpected events—whether illness, accidents, or loss of income—can derail even the best-laid financial plans. This is where insurance plays a vital role. Insurance is not just an expense; it is a financial safety net that…

Retirement may seem far away when you’re in your 20s or 30s but starting early is the single most effective way to ensure lasting financial security. Time is your greatest asset, thanks to the power of compounding. By saving…

Taking control of your money begins with smart budgeting—a simple yet powerful way to understand your financial situation and align your spending with your goals. Here’s a step-by-step guide to creating and sticking to an effective budget. Step 1:…

Managing debt is crucial for financial stability and peace of mind. Begin by listing all debts—credit cards, personal loans, student loans—and noting their balances, minimum payments, and interest rates. Two popular payoff strategies: Debt Snowball: Pay off smallest balances first…